lake county tax bill fl

6686076 email addresses are public records. Lake County Tax Collector.

A safe and secure payment option for Lake County services.

. Ad Property Tax Bill Info. The official Web site for the Lake County FL Board of County Commissioners. This tax estimation tool is provided to assist any potential home or business owner with an estimate of the ad valorem property taxes on a new purchase for properties within the municipalities and unincorporated areas of Lake County Florida.

The median property tax in Lake County Florida is 1757 per year for a home worth the median value of 178400. Lake County is located in northwest Central Florida. Ad Pay Your Taxes Bill Online with doxo.

Check out your options for paying your property tax bill. While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment. The assessors offices are working in the 2021.

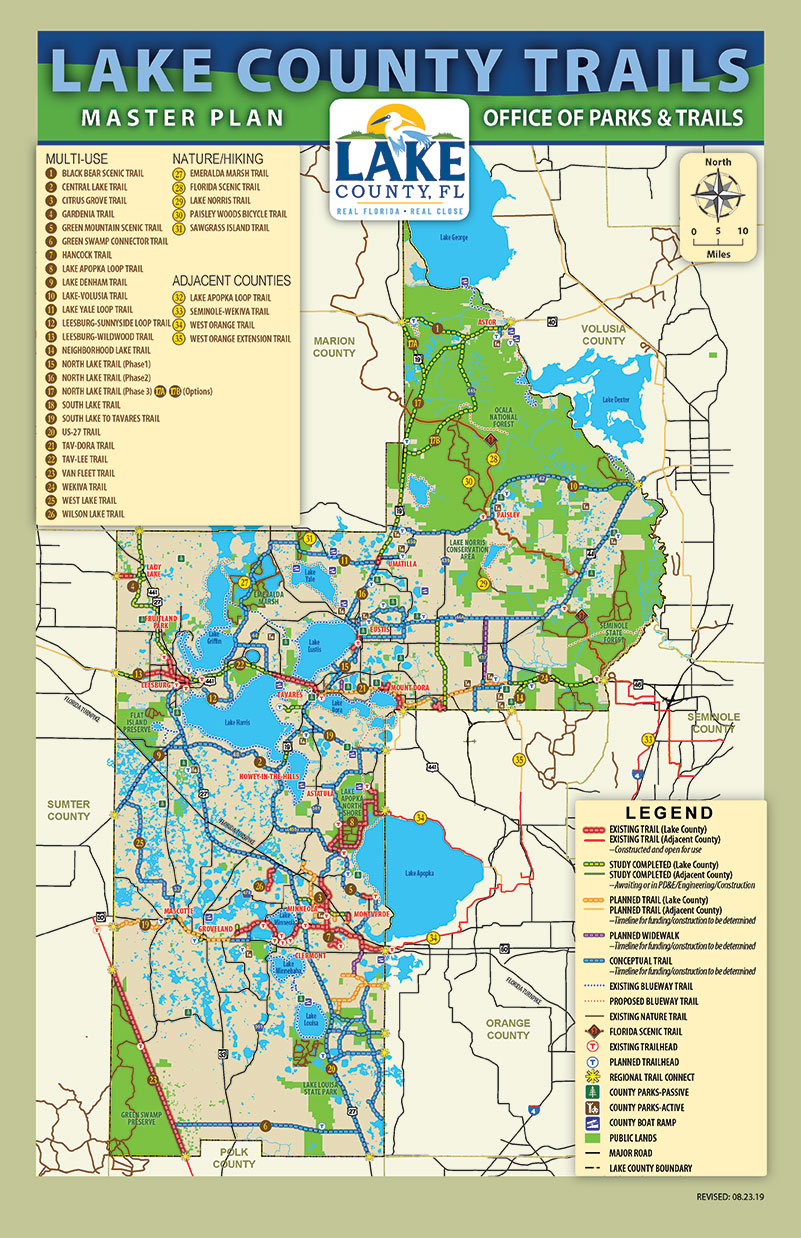

Review your email and confirm it. Gently rolling hills and glimmering lakes peacefully coexist with a high-tech industrial park and growing residential development. Lake County has one of the highest median property taxes in the United States and is ranked 597th of the 3143 counties in order of.

Past taxes are not a reliable projection of future taxes. Pay Mobile Home Property Tax. All dates are subject to change.

Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. The collection begins on November 1st for the current tax year of January through December. Pay for addressing and radio equipment.

847-377-2000 Contact Us Parking and Directions. In accordance with 2017-21 Laws of Florida 119 Florida Statutes. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non-ad valorem assessments which are levied for functions such as storm water utility solid waste collections or fire and rescue.

Duplicate tax bills for homeowners available at no charge. Jordan Lake County Tax Collector 320 West Main Street Administrative Office 2nd Floor Suite B Tavares Florida 32778 Phone. Property Taxes Mortgage 101476100.

Jordan Lake County Tax Collector 320 West Main Street Administrative Office 2nd Floor Suite B Tavares Florida 32778 Phone. Animal Shelter Donations. Once we have processed your purchase information and your name appears in our records as the owner you may file online for your 2022 tax-year homestead exemption.

Electronic Payments can be made online or by telephone 866 506-8035. ALL LENDERS TITLE COMPANIES WITHOUT THE ORIGINAL TAX BILL MUST INCLUDE 5 FOR A DUPLICATE BILL FEE PER PARCEL. Enter PIN or address.

School districts get the biggest portion about 69 percent. 6686076 email addresses are public records. This fee will be charged anytime a credit card is used when paying in person by phone or online.

The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts. In accordance with 2017-21 Laws of Florida 119 Florida Statutes. Due Dates for Property Taxes.

Tavares Florida 32778 Phone. Property Taxes No Mortgage 69941800. Lake County IL 18 N County Street Waukegan IL 60085 Phone.

Checks cashiers checks and money orders can be mailed to. Enter Any Address Receive a Comprehensive Property Report. Public Safety Support Payments.

Renew Vehicle Registration Search and Pay Property Tax Pay Tourist Tax Run a Real Estate report Run a Tangible Property report. The tax offices are working in the 2020 year which corresponds to the property tax bill property owners will receive in early May of 2021. 395 flat fee Visa only Pay Property Tax.

If you purchased a home in 2022 you willreceive a postcard from us once we have processed your purchase information. Yearly median tax in Lake County. Online E-Check only 150 flat rate fee applies if under 10000 you can use this option by changing the drop down from creditdebit to electronic check under payment method.

847-377-2000 Contact Us Parking and Directions. Lake County collects on average 098 of a propertys assessed fair market value as property tax. Donate to the Animal Shelter.

Tax Estimation Calculator. Enter a name or address or account number etc. Plus convenient Auto Pay options by contacting our office 440-350-2516.

Please note there is a convenience fee of 25 for creditdebit card payments or a 300 flat fee for an e-Check. A convenience fee will be charged by Lake County for each tax receipt paid with a credit card in accordance with Montana Codes Annotated 7-6-617. Or call the Lake County Treasurers Office at 847-377-2323.

You may then pre-file for your 2023 tax year homestead exemption. Please ensure your line of credit covers the tax payment amount as well as the additional fee. Select the proper tax year in the drop-down menu and click Tax Bill.

These real estate taxes are collected on an annual basis by the Lake County Tax Collectors Office. Enter a name or address or account number etc. Tavares Florida 32778 Phone.

Search all services we offer. IT IS THE RESPONSIBILITY OF EACH PROPERTY OWNER TO SEE THAT THEIR TAXES ARE PAID AND THAT THEY DO INDEED RECEIVE A TAX BILL. Pay Your County Taxes Online.

In a few minutes you should receive an email containing instructions on how to activate your new user account. Lake County BCC. Skip to Main Content.

See Results in Minutes. Lake County Property Tax Collections Total Lake County Florida. Currently accepting Visa and Mastercard.

Lake County IL 18 N County Street Waukegan IL 60085 Phone.

Property Taxes Lake County Tax Collector

Property Tax Search Taxsys Lake County Tax Collector

Florida Property Tax H R Block

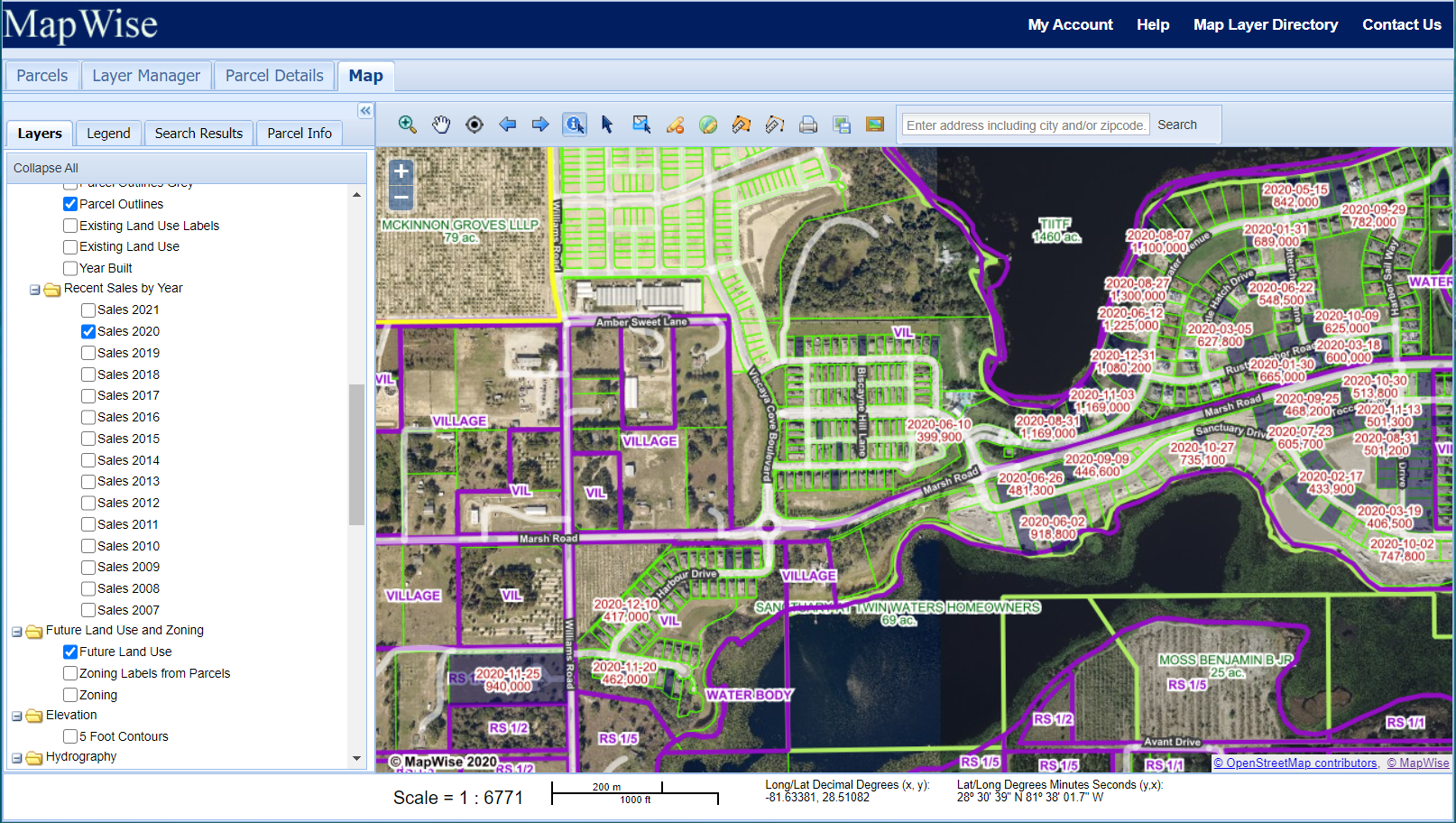

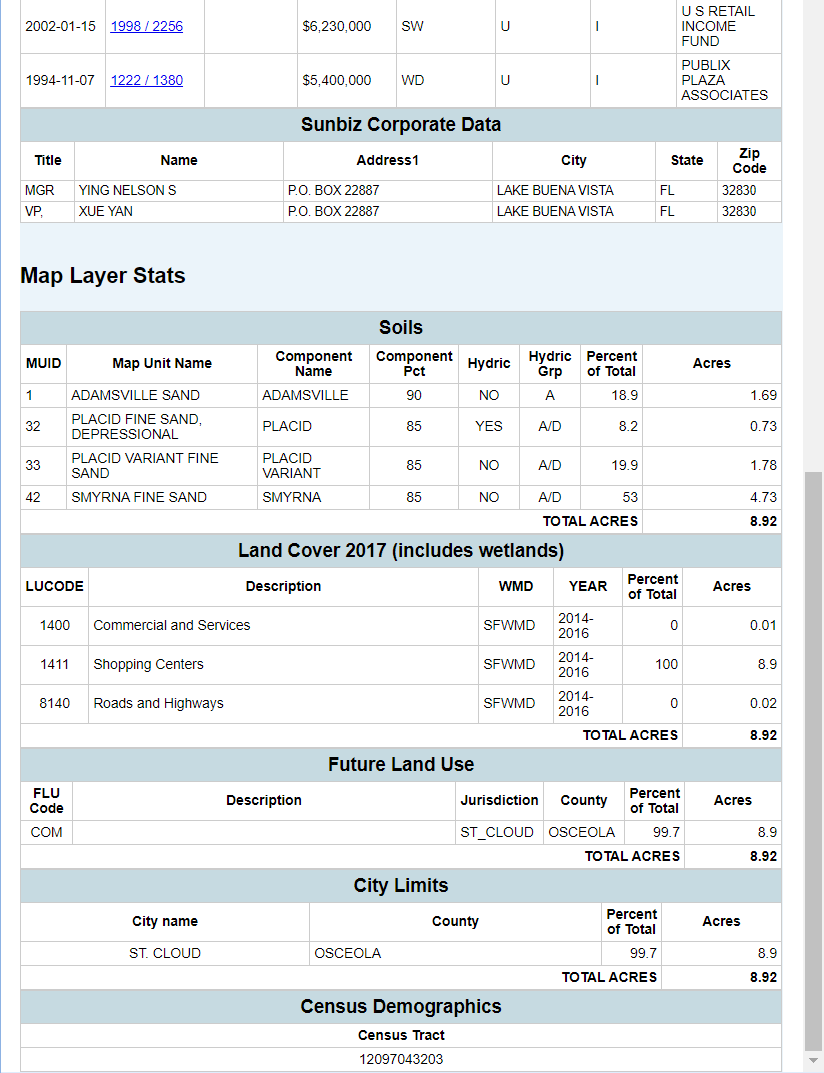

Florida County Property Appraiser Search Parcel Maps And Data

Clerkpay Online Court Payments

Florida County Property Appraiser Search Parcel Maps And Data

Property Taxes Lake County Tax Collector

Lake County Il Property Tax Information

Lake County Il Property Tax Information